Unlocking Trapped Value from Aged CRE Assets

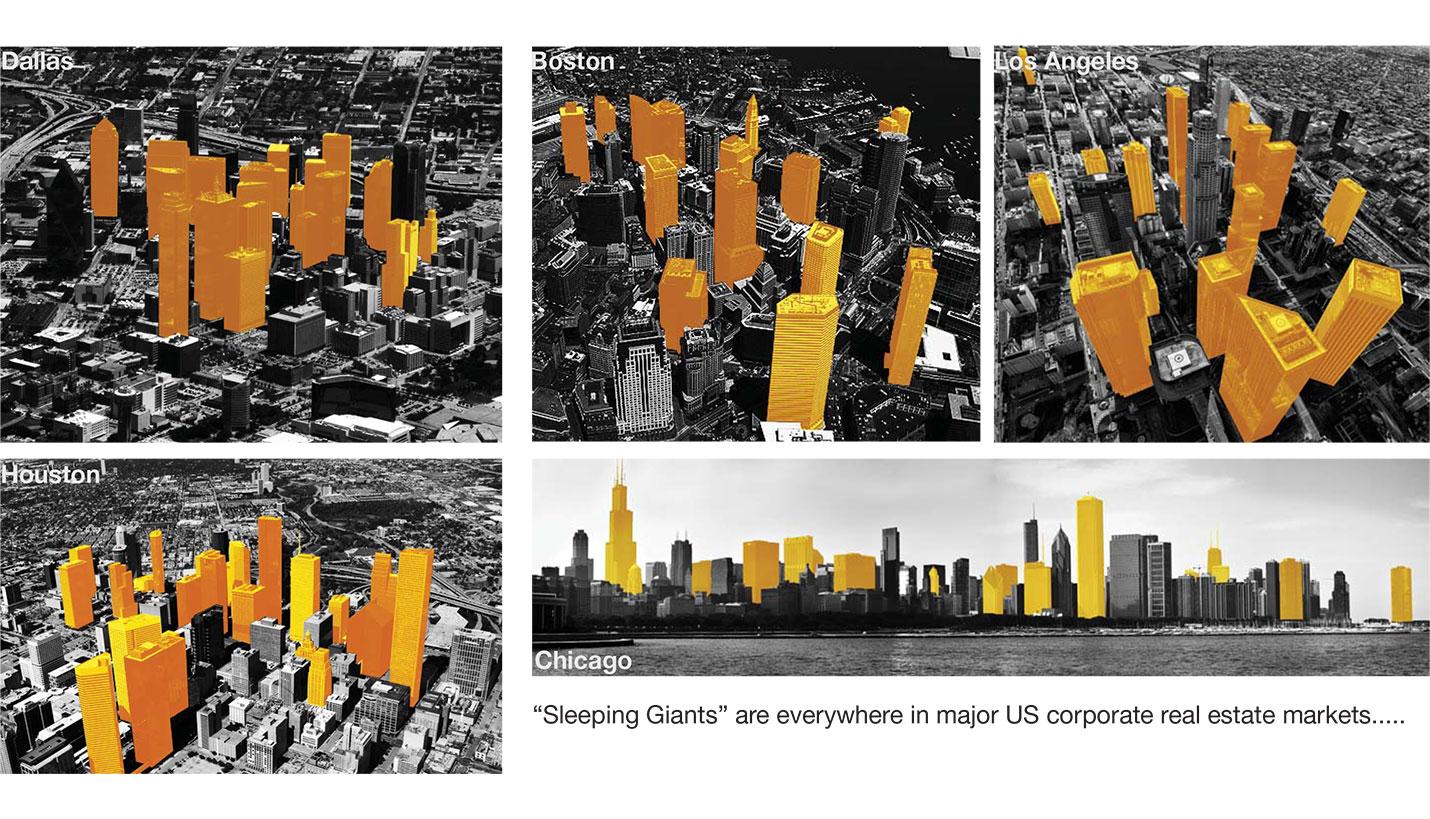

‘Sleeping Giants’ are not fairy tale creatures, nor historic architectural icons like the Empire State building in New York City and the Wells Fargo Building in Denver. In corporate real estate, sleeping giants are the vast stock of older, more prosaic, buildings dominating our skylines. They are valuable building assets that struggle to compete as cities change around them and new buildings enter their markets, luring away prime tenants.

One of Page's multidisciplinary consulting teams specializes in identifying ways to unlock trapped value in these aging assets, as seen in the above image gallery with accompanying captions, and make them more competitive against new construction. As each asset, its surroundings and market are unique, so are the solutions that Page identifies for their owners, landlords and brokers. The Page team has presented at events like CoreNet Global Summit and their work has been featured in publications such as National Real Estate Investor and Colorado Real Estate Journal.

This type of commercial real estate building has a significant common factor: their age. They were built before a large number of form-giving developments in building technology were introduced. For example, the ethernet was standardized in 1983; cellular telephones were introduced in 1984; the internet backbone was created in 1992; the US Green Building Council was established and underfloor air systems were incorporated into signature projects in 1993; and certainly before building automation systems emerged around 2000.

These buildings were planned and designed for a traditional idea of the corporate office environment, well before Richard Florida chronicled the rise of the creative class of workers in 2002 and pop culture lambasted the drudgery of high-walled cubicle environments in movies like ‘Office Space’ and ‘The Incredibles’ (not to mention the ubiquitous Dilbert comic strip from the mid 1990s). These buildings have very little of the amenity infrastructure to help them compete with the redefinition of workspace led by creative twenty-first century firms like Google, which went public in 2004, the same year its free-spirited approach to workspace was widely published and won numerous design awards.

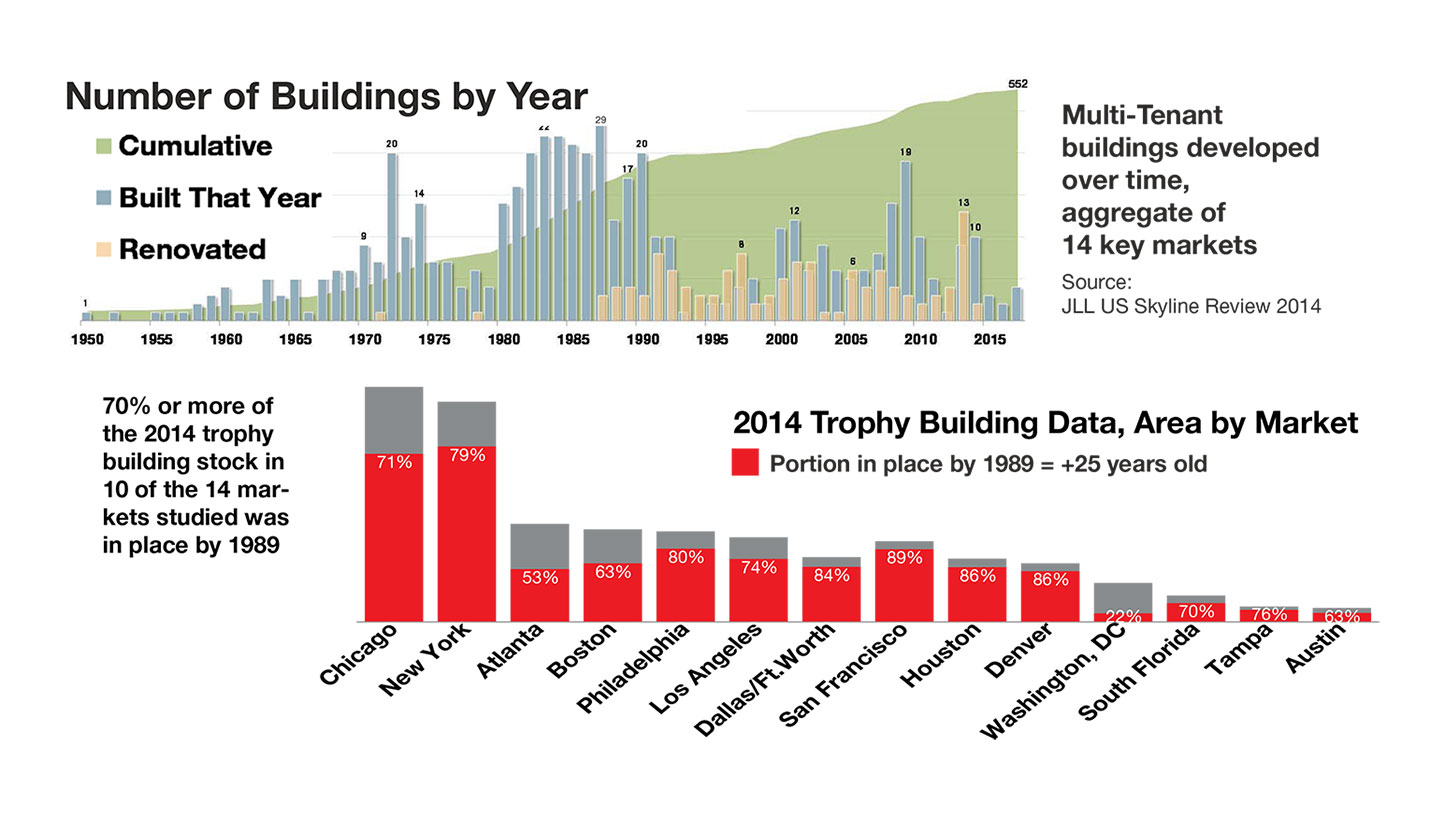

To illustrate the scale of aging asset inventory across the country, the Page team analyzed building data across fourteen key U.S. corporate real estate markets (Images #2 and #11). Our analysis was built on JLL’s (Jones Lang LaSalle) Spring 2014 US Skyline Review; the buildings included represent the top quality urbanized office micro-markets in each city. We graphed today’s buildings by year completed since 1950 to show that the vast majority of our current multi-tenant office buildings were in place by 1990 – almost 25 years ago. This building landscape is familiar to many – we can see it down many streets throughout most of the cities we work in – and this is the opportunity to reposition assets facing our industry.

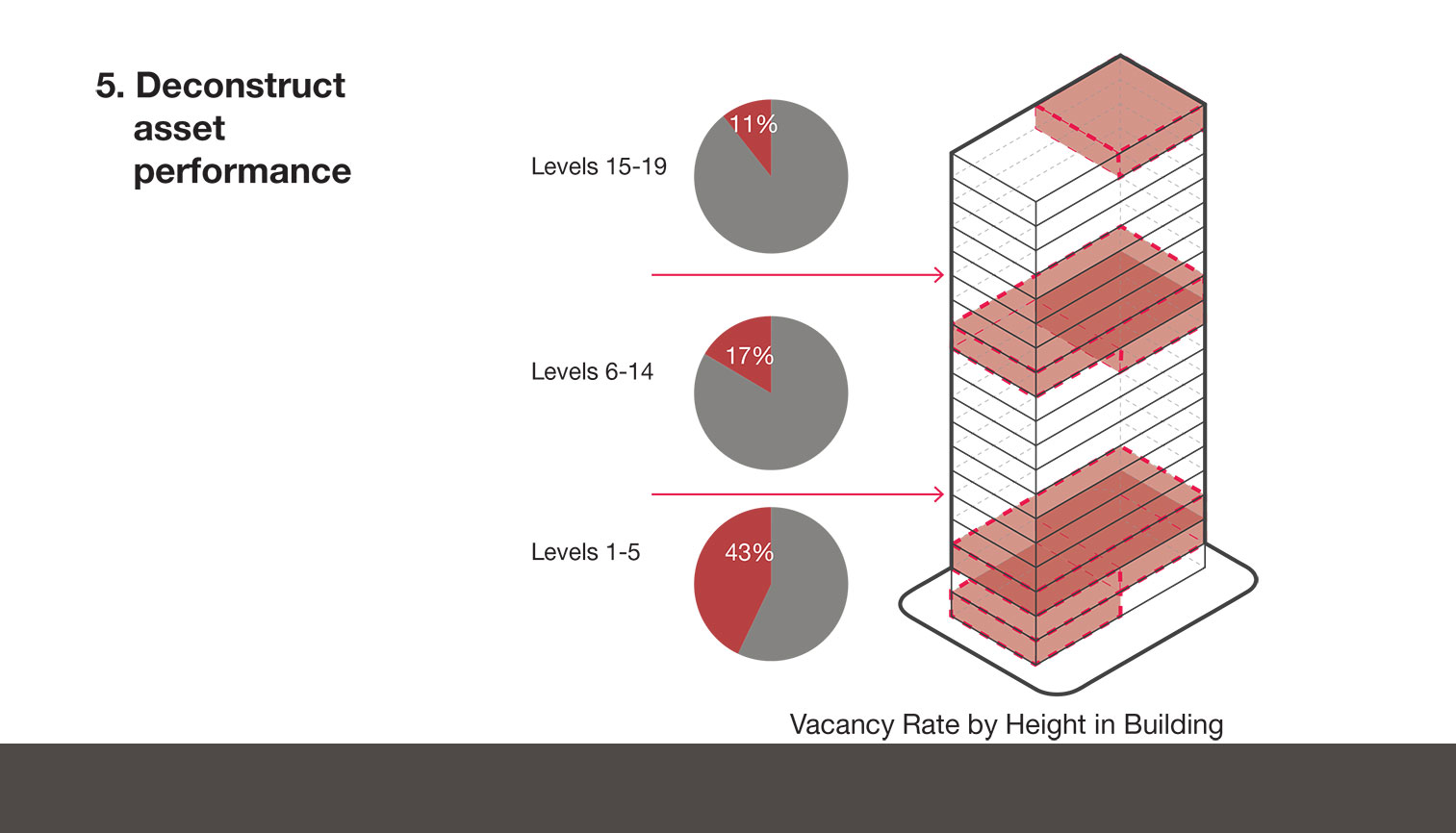

While new office tower construction is exciting, the bigger and more enduring story lies in understanding how the buildings in the background must reposition themselves to remain relevant. The bottom line is that aging assets become candidates for repositioning when there is evidence that investment will result in higher occupancy, increased rental rates, and a positive return on the investment (Image #5).

Repositioning starts with asset ownership

Key considerations for asset owners contemplating repositioning their aged assets are the current and desired market position of the space, timing, potential revenue, and approach.

A market position in corporate real estate is often described by ‘class’. When an owner believes an asset has potential to perform like a class A or AA property, but knows that the asset is widely considered a Class B building by the local market, improving that perception of the building can be a primary driver for repositioning an investment.

Timing is a crucial factor in strategically repositioning a building. First, consider the duration the property will be held and resulting window for improved returns to materialize. Some repositioning investments will impact revenues more quickly than others. Secondly, when new buildings are coming online that may compete for desirable tenants, strategic repositioning projects can take advantage of relatively short delivery cycles and beat a ground-up construction project to market. Finally, a major vacancy can trigger repositioning, offering both incentive to improve leasability and simplified construction.

Revenue concerns often trigger repositioning. To justify the investment, asset owners must believe that material increases in rental rates can be achieved and the building will be leased more quickly. Alternately, doing nothing may risk both a reduction in rental rates over time, and increased difficulty leasing vacant space. Yet, revenue forecasting models are limited. Predicted return on any investment is based upon best guess assumptions and may change as unanticipated factors impact market conditions.

Key to effective repositioning is to take a fresh look at the property. Asset insiders may find it difficult to imagine all the viable possibilities. A design competition can be a great tool to solicit ideas before finalizing the project scope and selecting a design team. Offering payment helps to ensure that design firms will dedicate their best resources, and setting up the competition brief with minimal guidance from the owner can free designers to generate unexpected visions for the project.

Approaches to release trapped value

Through experience across numerous repositioning projects, we have identified ten key approaches to identifying and unlocking trapped asset value. Refer to the above image gallery with corresponding captions in images #2 - #12 for details.

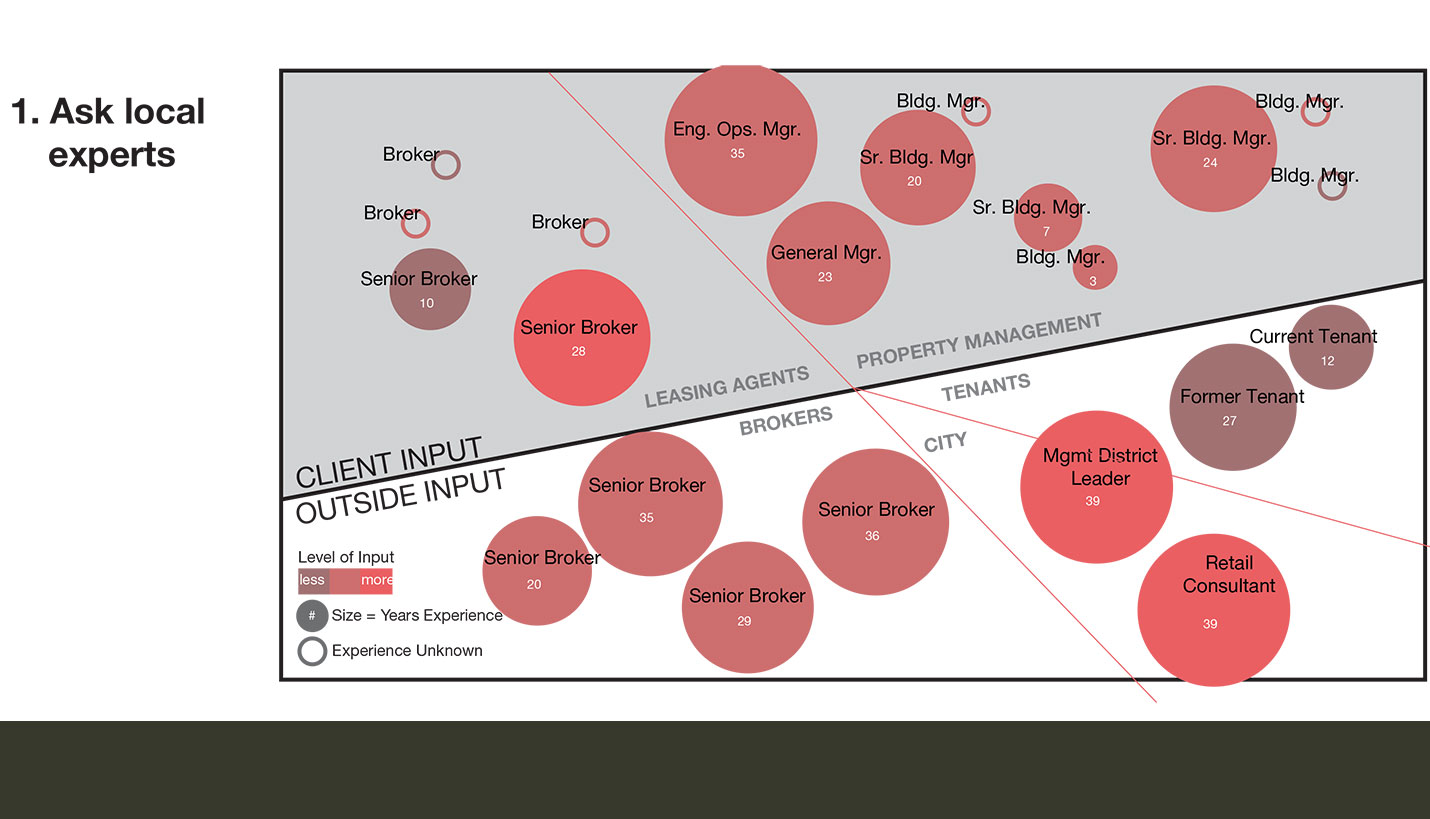

- Ask local experts

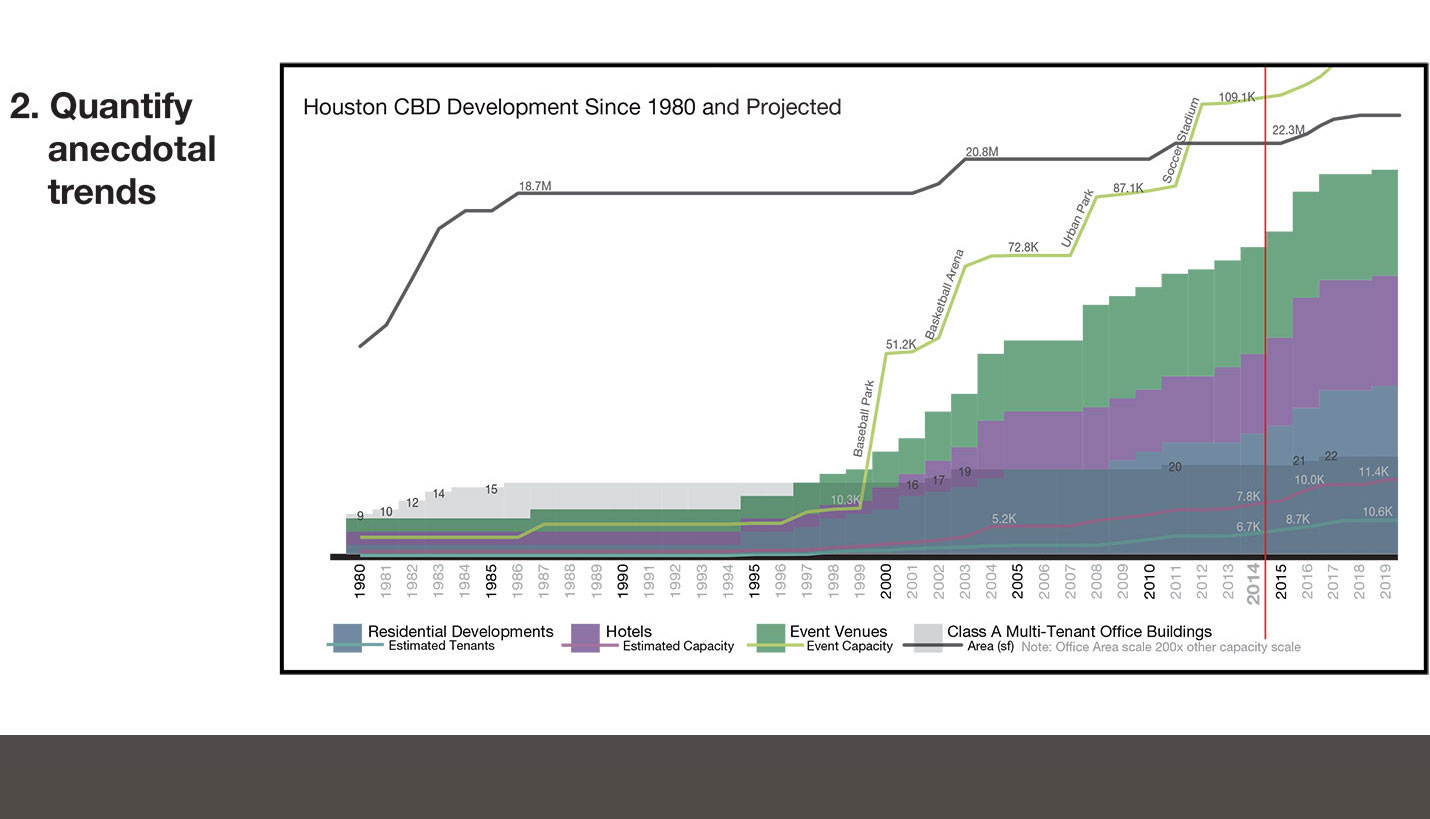

- Quantify anecdotal trends

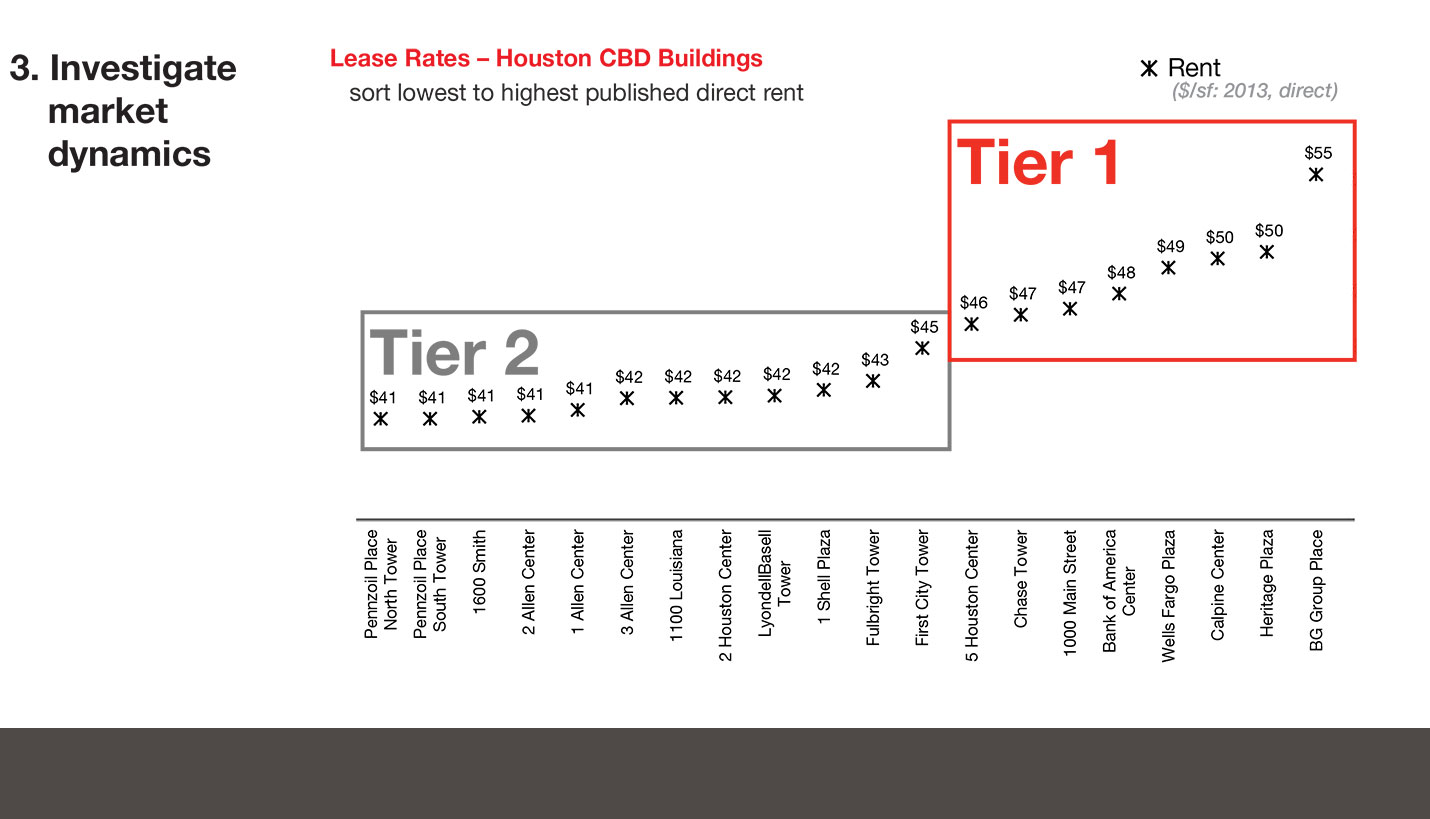

- Investigate market dynamics

- Understand location and context

- Deconstruct asset performance

- Engage immediate partners

- Establish the foreground

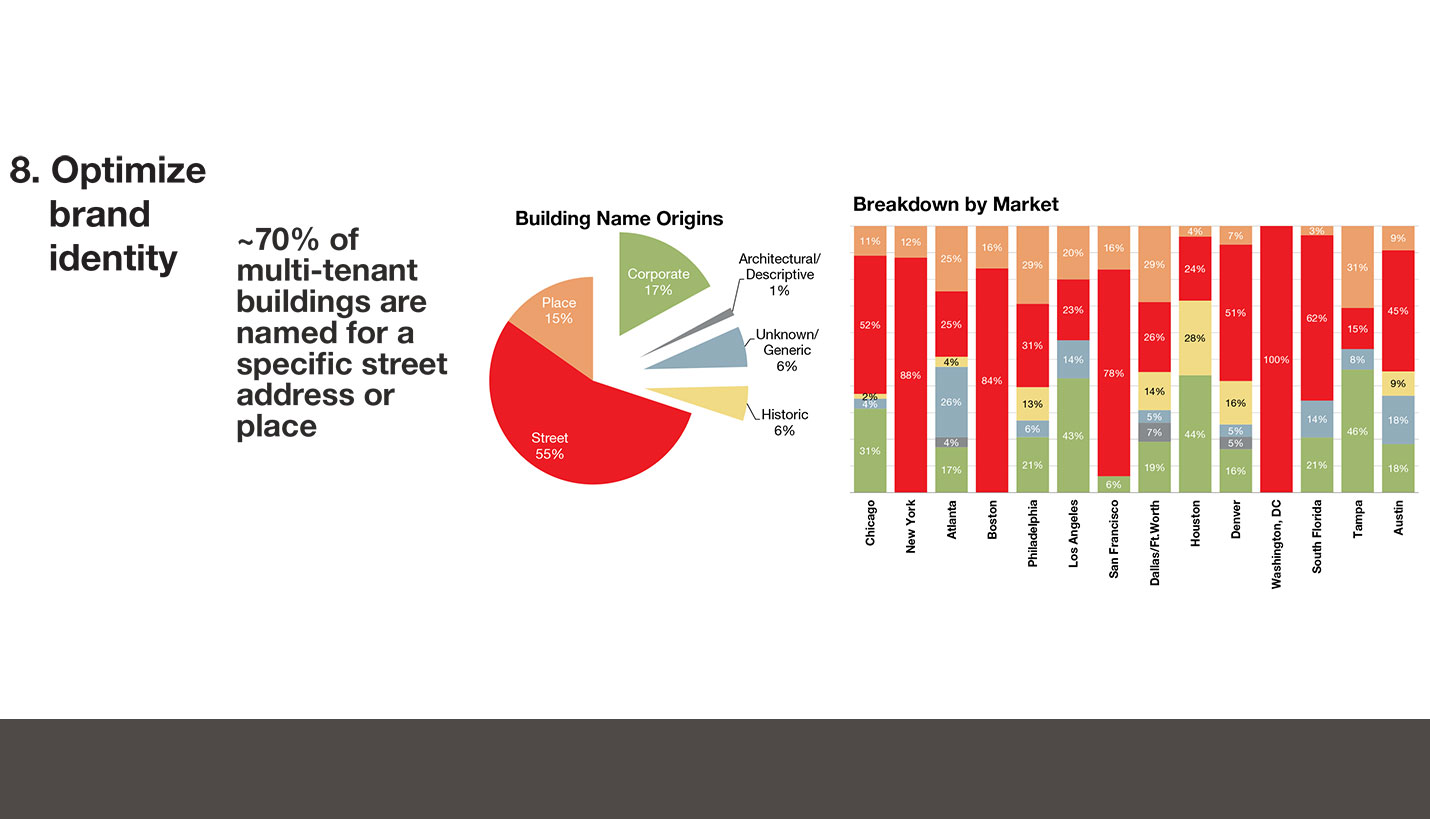

- Optimize brand identity

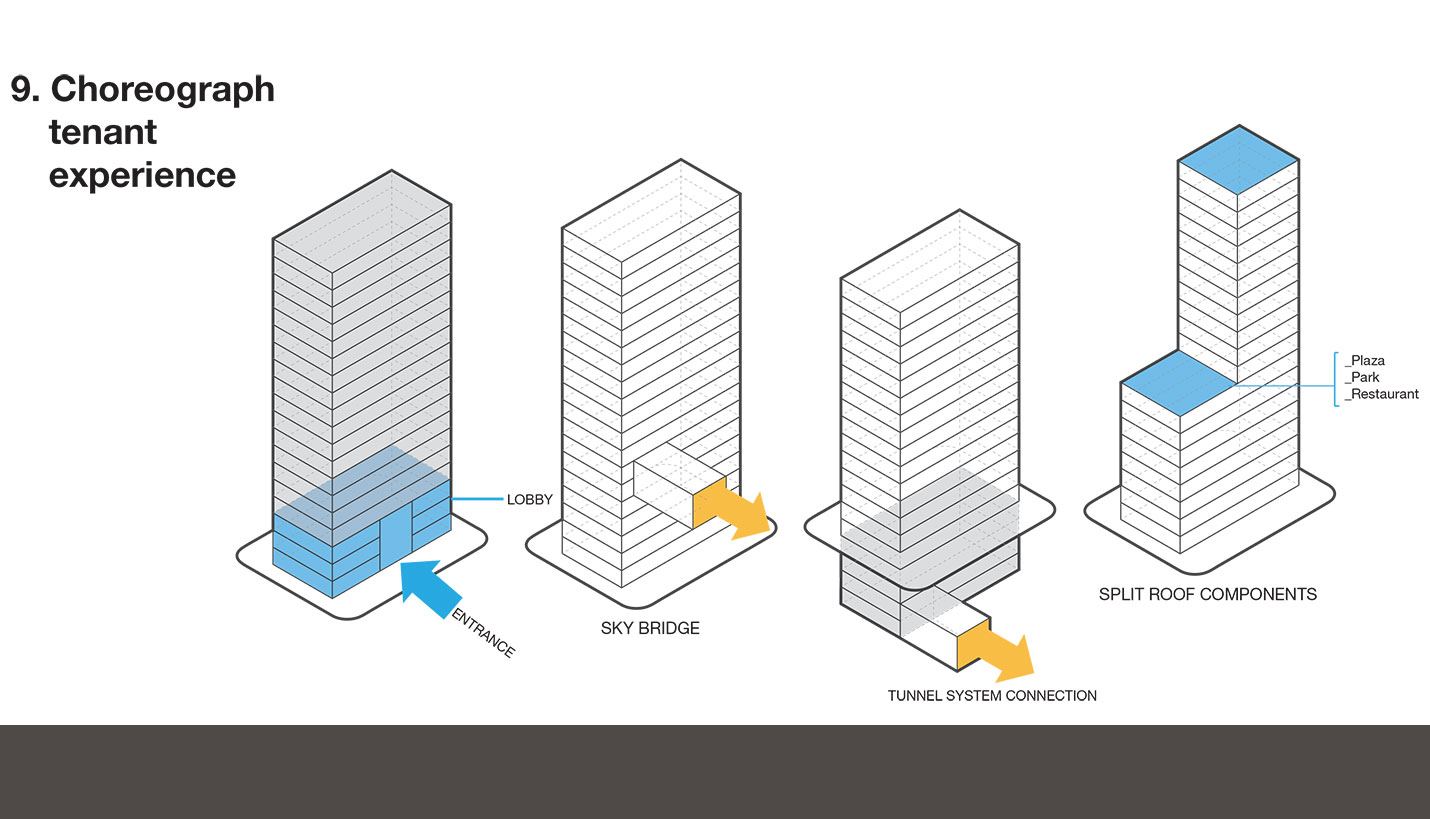

- Choreograph tenant experience

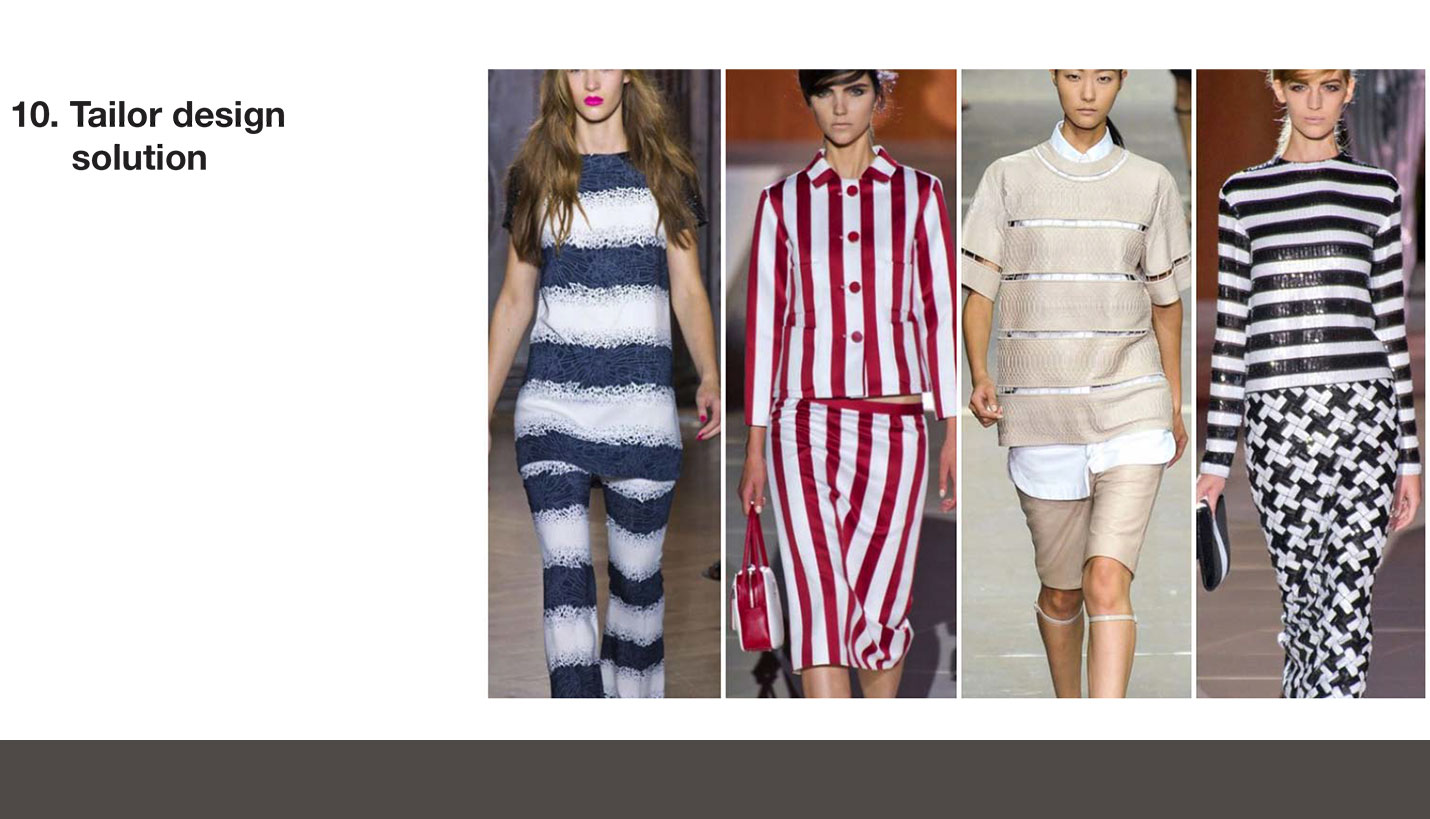

- Tailor design solutions

Scale of opportunity

Specific repositioning strategies vary by building and market, but we calculate that the opportunity is enormous. While Chicago and New York represent almost 40% of the national trophy building stock, 70% or more of the trophy buildings across 10 of the 14 markets we studied are at least 25 years old. The opportunity to unlock value through strategic repositioning is local and national. Put another way, 66% of buildings representing 73% of rentable area across major US markets fall in this category.

If older assets are repositioned just to their respective current market mean lease rates, an additional $330 million dollars in annual rent could be garnered.

As a new building cycle plays out across our country, the newly constructed trophy buildings are hard-wired, Wi-Fi blanketed, broadband connected, power dense, sustainable, efficient, VOC-free, daylight penetrated, high-ceilinged, flexible, amenity rich and work-life supporting. The question aging asset owners have to ask themselves is: who will help me unlock the trapped value in my asset to remain competitive?

For more information, please refer to the Resource file on the right: "Sleeping Giants and Aging Assets are Everywhere," by Jamie Flatt. Colorado Real Estate Journal Office Properties Quarterly, January 2015.

Contributed By

Jamie Flatt, Page Strategic Consultant

01/23/2015