Green Building Financing

Although many project teams aim to incorporate sustainable strategies into project designs, the construction cost of some of the most effective energy conservation measures is often not included in the development of project budgets, which are frequently based on conventional design strategies. Managing construction cost expectations requires close collaboration with cost estimators and contractors throughout the design process. Even with an integrated design team, many project teams must conduct a Value Engineering (VE) process to align design goals with estimated construction costs. The disadvantage of any VE exercise is the potential loss of project quality or scope, which is acutely felt by high performance building projects relying on design synergies to achieve performance targets. The careful calibration of systems in high performance buildings is lost if components are removed or changed during the VE process.

The sustainable design consultant’s role is to identify and endorse elements that add long-term value through high performance design. Communicating the business case for sustainable design initiatives is critical. It is imperative in the early design stages to uncover the owner’s long-range energy conservation goals.

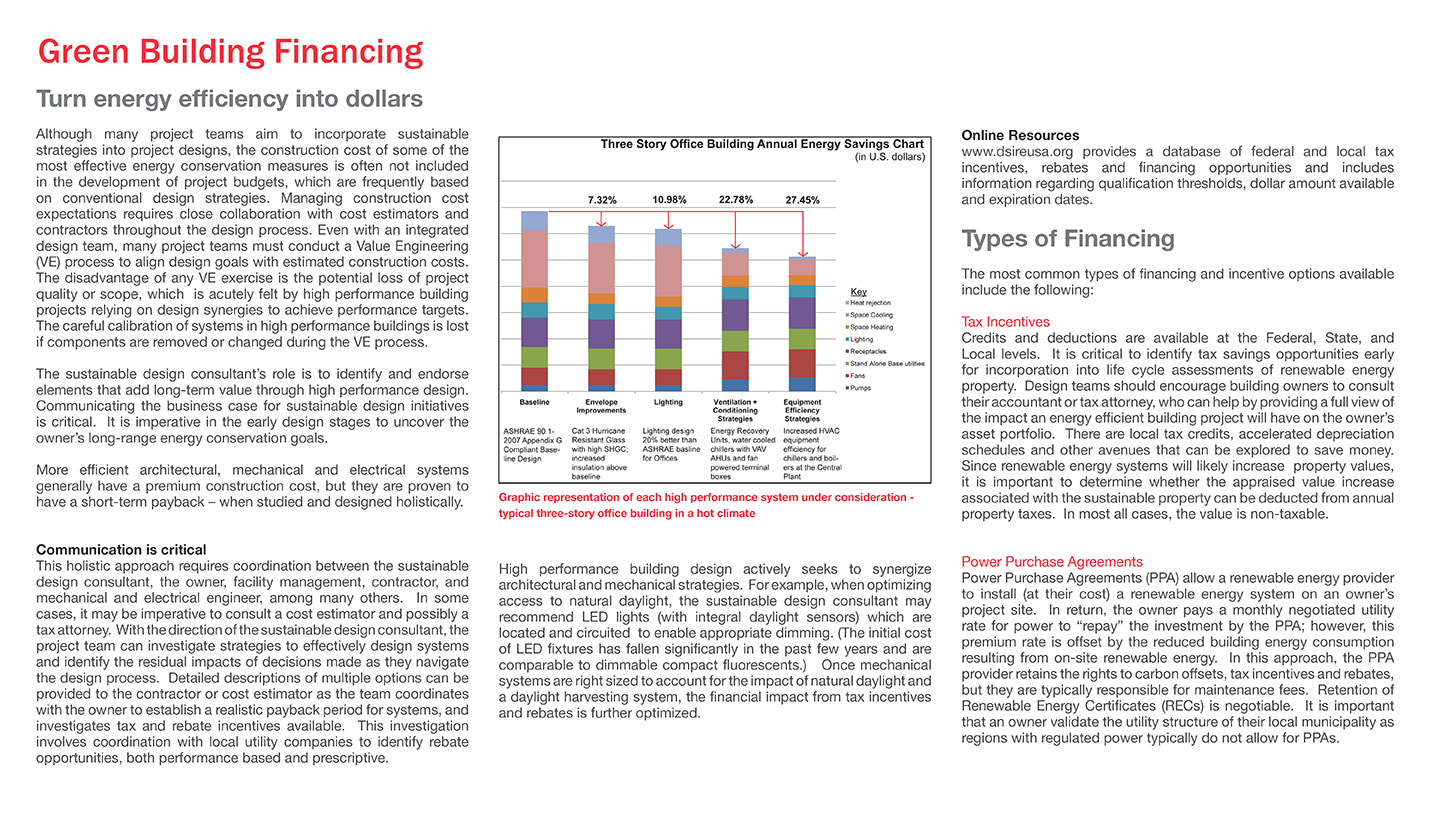

More efficient architectural, mechanical and electrical systems generally have a premium construction cost, but they are proven to have a short-term payback – when studied and designed holistically.

Communication is critical

This holistic approach requires coordination between the sustainable design consultant, the owner, facility management, contractor, and mechanical and electrical engineer, among many others. In some cases, it may be imperative to consult a cost estimator and possibly a tax attorney. With the direction of the sustainable design consultant, the project team can investigate strategies to effectively design systems and identify the residual impacts of decisions made as they navigate the design process. Detailed descriptions of multiple options can be provided to the contractor or cost estimator as the team coordinates with the owner to establish a realistic payback period for systems, and investigates tax and rebate incentives available. This investigation involves coordination with local utility companies to identify rebate opportunities, both performance based and prescriptive.

High performance building design actively seeks to synergize architectural and mechanical strategies. For example, when optimizing access to natural daylight, the sustainable design consultant may recommend LED lights (with integral daylight sensors) which are located and circuited to enable appropriate dimming. (The initial cost of LED fixtures has fallen significantly in the past few years and are comparable to dimmable compact fluorescents.) Once mechanical systems are right sized to account for the impact of natural daylight and a daylight harvesting system, the financial impact from tax incentives and rebates is further optimized.

Online Resources

www.dsireusa.org provides a database of federal and local tax incentives, rebates and financing opportunities and includes information regarding qualification thresholds, dollar amount available and expiration dates.

Types of Financing

The most common types of financing and incentive options available include the following:

Tax Incentives

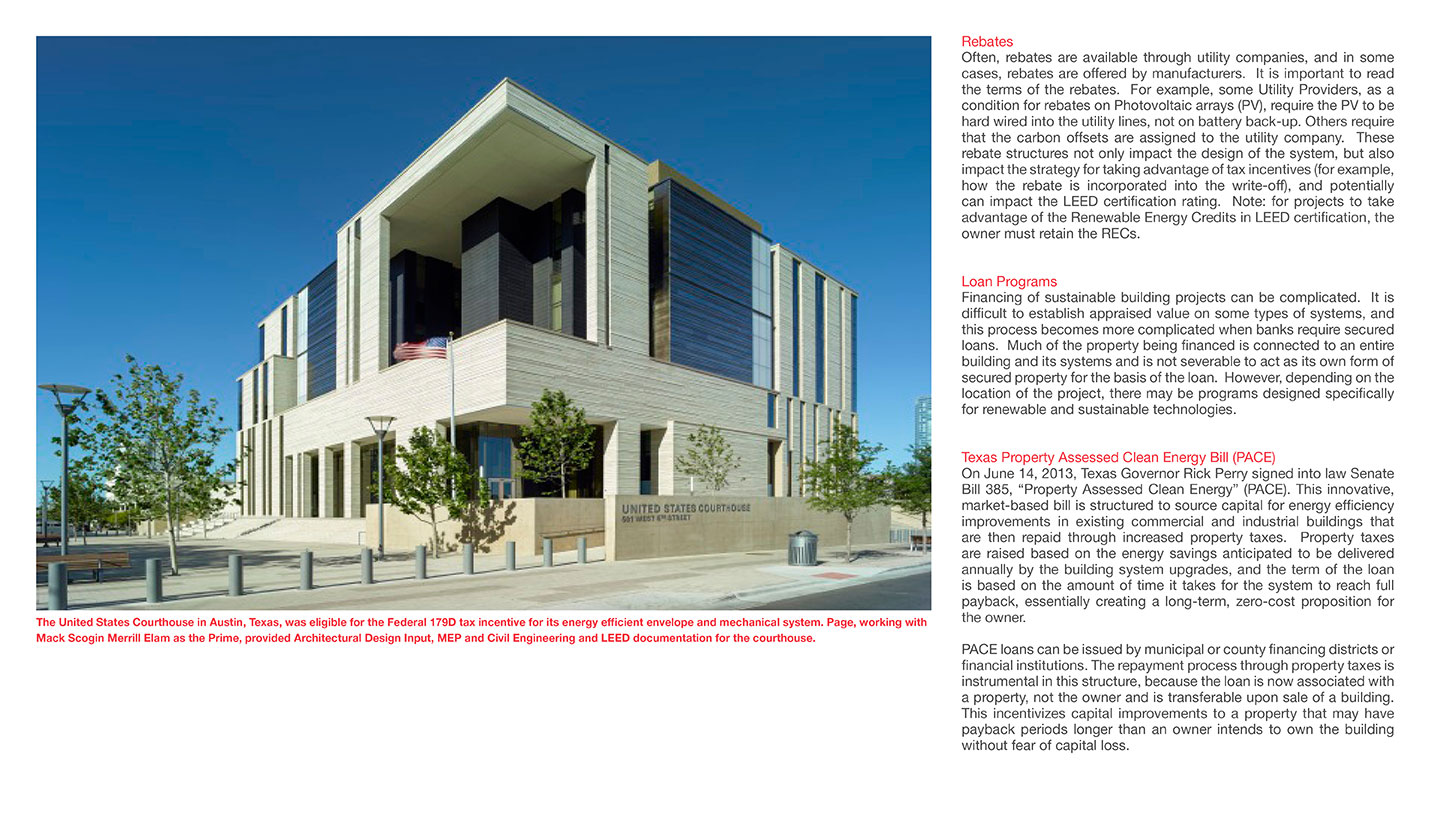

Credits and deductions are available at the Federal, State, and Local levels. It is critical to identify tax savings opportunities early for incorporation into life cycle assessments of renewable energy property. Design teams should encourage building owners to consult their accountant or tax attorney, who can help by providing a full view of the impact an energy efficient building project will have on the owner’s asset portfolio. There are local tax credits, accelerated depreciation schedules and other avenues that can be explored to save money. Since renewable energy systems will likely increase property values, it is important to determine whether the appraised value increase associated with the sustainable property can be deducted from annual property taxes. In most all cases, the value is non-taxable.

Power Purchase Agreements

Power Purchase Agreements (PPA) allow a renewable energy provider to install (at their cost) a renewable energy system on an owner’s project site. In return, the owner pays a monthly negotiated utility rate for power to “repay” the investment by the PPA; however, this premium rate is offset by the reduced building energy consumption resulting from on-site renewable energy. In this approach, the PPA provider retains the rights to carbon offsets, tax incentives and rebates, but they are typically responsible for maintenance fees. Retention of Renewable Energy Certificates (RECs) is negotiable. It is important that an owner validate the utility structure of their local municipality as regions with regulated power typically do not allow for PPAs.

Rebates

Often, rebates are available through utility companies, and in some cases, rebates are offered by manufacturers. It is important to read the terms of the rebates. For example, some Utility Providers, as a condition for rebates on Photovoltaic arrays (PV), require the PV to be hard wired into the utility lines, not on battery back-up. Others require that the carbon offsets are assigned to the utility company. These rebate structures not only impact the design of the system, but also impact the strategy for taking advantage of tax incentives (for example, how the rebate is incorporated into the write-off), and potentially can impact the LEED certification rating. Note: for projects to take advantage of the Renewable Energy Credits in LEED certification, the owner must retain the RECs.

Loan Programs

Financing of sustainable building projects can be complicated. It is difficult to establish appraised value on some types of systems, and this process becomes more complicated when banks require secured loans. Much of the property being financed is connected to an entire building and its systems and is not severable to act as its own form of secured property for the basis of the loan. However, depending on the location of the project, there may be programs designed specifically for renewable and sustainable technologies.

Texas Property Assessed Clean Energy Bill (PACE)

On June 14, 2013, Texas Governor Rick Perry signed into law Senate Bill 385, “Property Assessed Clean Energy” (PACE). This innovative, market-based bill is structured to source capital for energy efficiency improvements in existing commercial and industrial buildings that are then repaid through increased property taxes. Property taxes are raised based on the energy savings anticipated to be delivered annually by the building system upgrades, and the term of the loan is based on the amount of time it takes for the system to reach full payback, essentially creating a long-term, zero-cost proposition for the owner.

PACE loans can be issued by municipal or county financing districts or financial institutions. The repayment process through property taxes is instrumental in this structure, because the loan is now associated with a property, not the owner and is transferable upon sale of a building. This incentivizes capital improvements to a property that may have payback periods longer than an owner intends to own the building without fear of capital loss.

Contributed By

Katie Blair

12/19/2014

Blog Resources

Related Posts

- On-Site Renewable Energy: Solar

- Net Zero Water

- Case Study: Creating an Energy Efficient, Intelligent Building in Finland

- Case Study: Sustainable Design at University of Colorado - Colorado Springs

- Sustainability in Action at Page

- Faster building performance analysis helps architects meet AIA 2030 goals

- Tempering the Temporary: Improving thermal comfort and safety in relief shelters